Is the market going up or down?

Now that's a question most of us are asking ourselves while looking for guidance.

I see 2 ways of the S&P500 playing out, either up or down. Wow that sounds pretty general right? *laughing*

I will post charts, being as of course most Fridays seem to land in a dead zone where we don’t really have a clear direction.

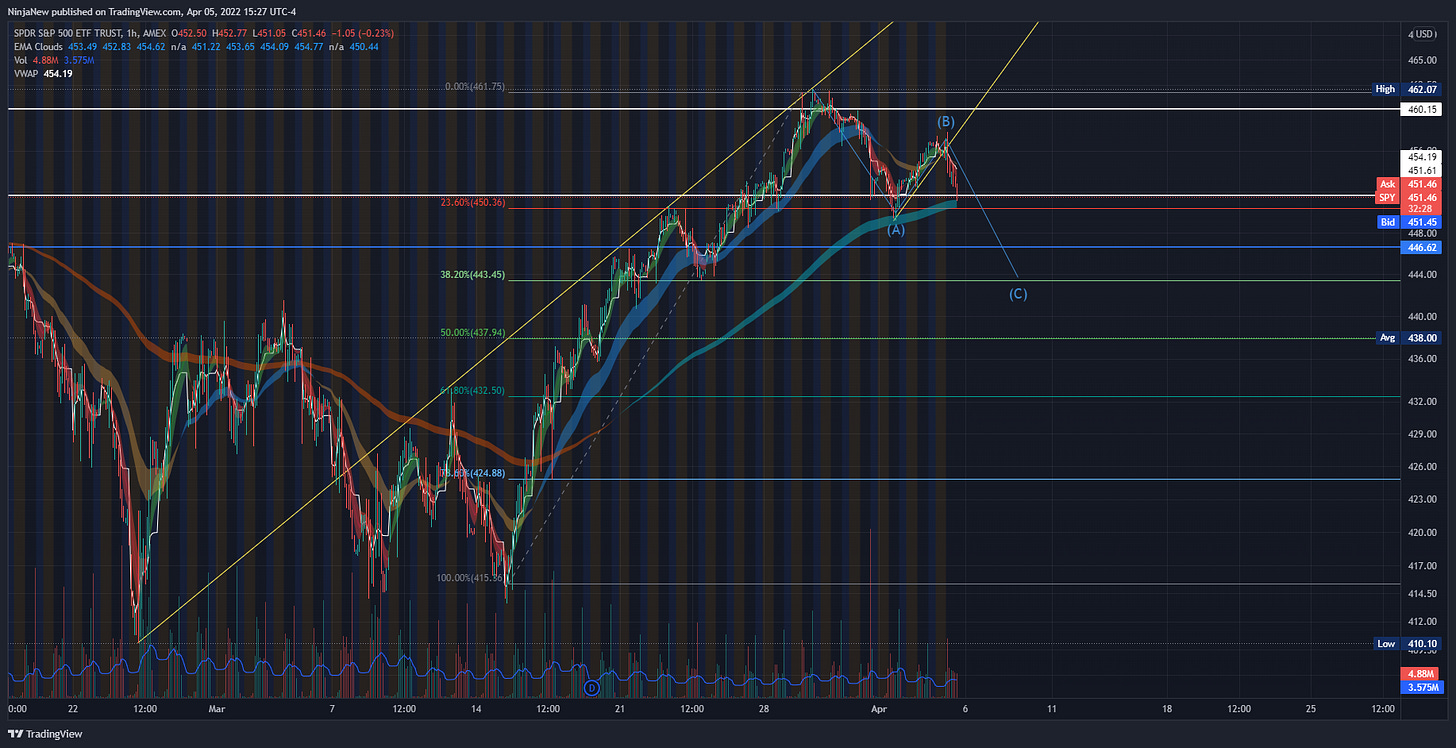

SPY did exactly as I thought it would do retracement wise, that still leave us in uncertainty because SPY didn’t hold all the gains from its bounce off the 443.47 retracement going into the close of the week.

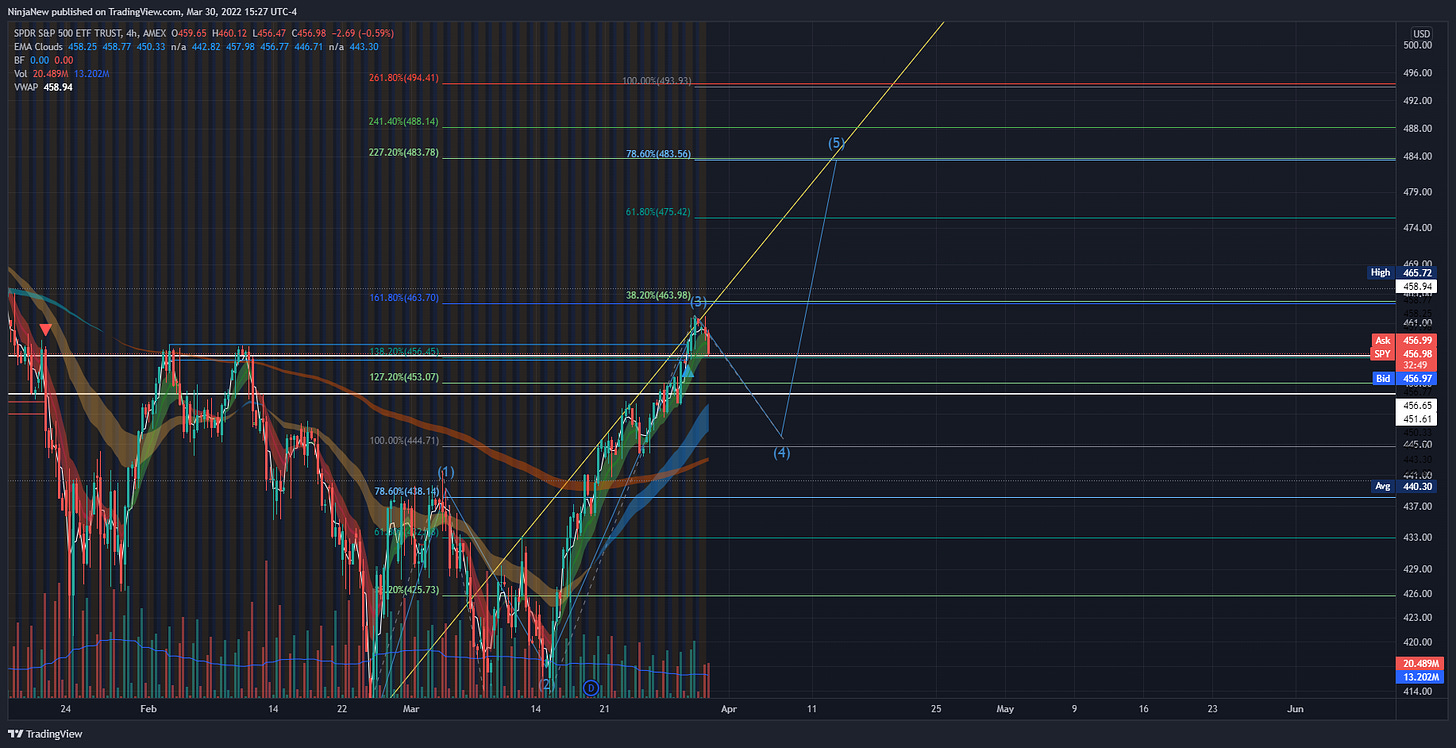

Below I will post 2 scenarios I see playing out, you choose for yourself which one you feel like is most likely to play out.

This is how I feel if we have a continuation, no numbers are exact, this is only for perspective reason.

So currently I have been releasing my newsletters for free and do plan to do several more so people can get a taste of what some of the newsletters will contain. I eventually do plan to make at least 75% of my newsletters paid at about $5-$10/mo. I do not mind sharing ideas and such (as I do in most of discords I am in), but with the amount of time I put into doing the research, charting, putting the newsletter into an easy-to-read format (being able to check research through links). I do feel it warrants some of compensation for my time, most paid newsletters will be available 1-3 weeks after its posted, but some/most of the trades might be invalid by then. I am grateful for all the readers/subscribers regardless of free or paid versions, and hope that readers will continue to come back regardless of subscription type. With that being said I hope you find usefulness of the content below.

DCFC (Tritium DCFC Limited) Website

Let’s talk about Tritium, this is something I have been watching since it was a SPAC, before the merger completion. I suggest you clink the link above to find a little more out about this company. I know there is a lot of EV charger plays out there, but I really like Tritium over some of the others. I think from the looks of it they build high quality chargers, ranging from commercial to industrial (several models).

Now I am currently not in this stock, but there is a possibility I would enter this trade at the $8.31-$8.57 range. This is solely depending on how the stock holds up in that range with a pretty tight stoploss. Now looking at the chart we can see the $6.85 area seems to be a decently strong support for a newer trading stock, this is where I would really like to grab and accumulate this stock if the opportunity arises (THIS DOES NOT GAURENTEE IT WILL NOT GO LOWER). I will be transparent on the fact I do plan to acquire this stock slowly for a bigger move as we continue into the “EV era”, and infrastructure will continue to grow.

So, you may ask why Tritium instead of e.g. Blink & Volta? Well already looking at the difference (style, design, quality) in the chargers alone has me sold on Tritium, along with their 15-45 minute fast charging & ability their chargers able to withstand pretty much any climate, they are targeting the commercial/industrial market. Blink is more residential/light commercial targeted. Volta which is aimed for commercial locations, which advertisements on their large screened chargers is their marketing tactic.

So how would I take this trade?

A simple momentum play for when EV sector is in rotation.

Longer term DCA invest for the bigger move (15% starter position).

This is simply something I believe should be added to both your momentum/daytrade WL, as well as a long-term/dca WL.

BCRX (BioCryst Pharmaceuticals Inc.) Website

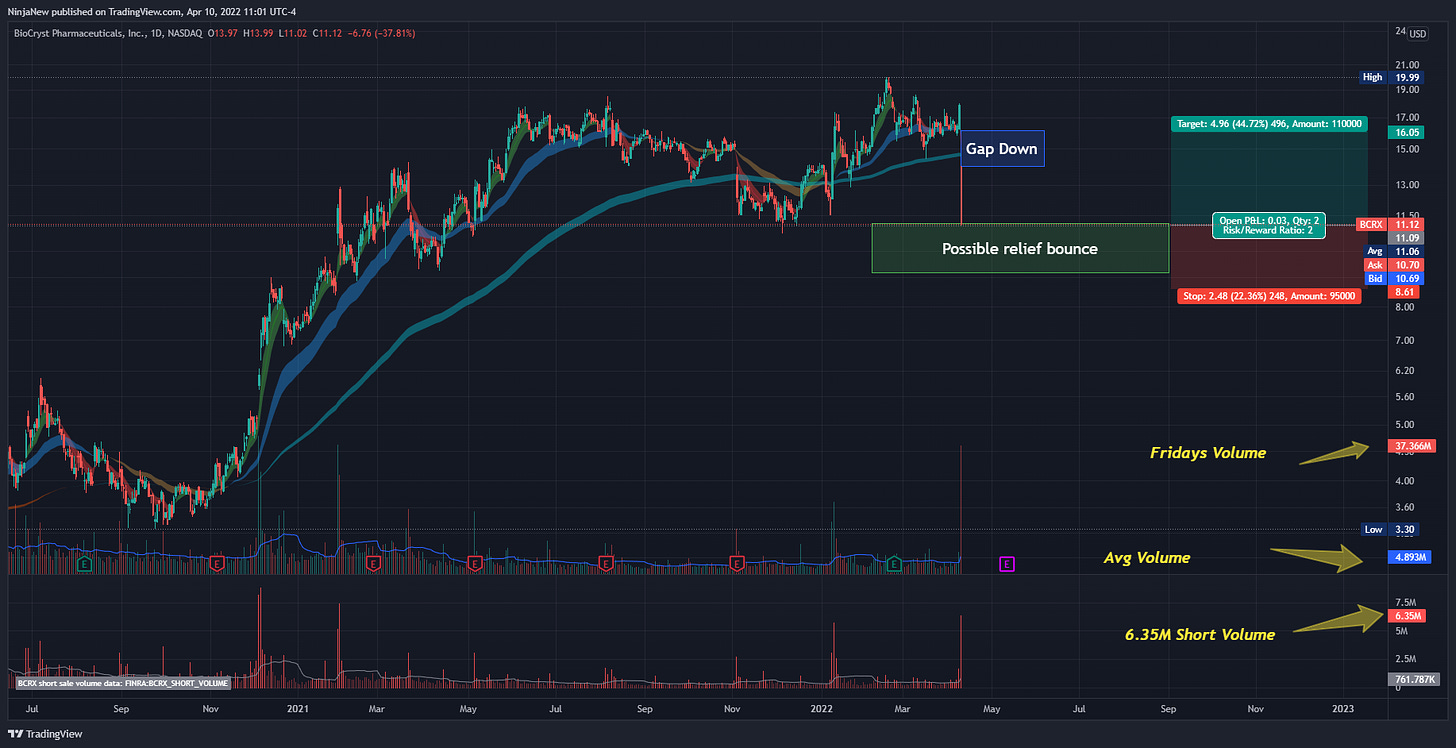

Let us look at BCRX=holy gap down and a little over -37.81% drop

Crazy, what a hell of a drop on a enrollment pause. (link to article below)

BioCryst enrollment pause article

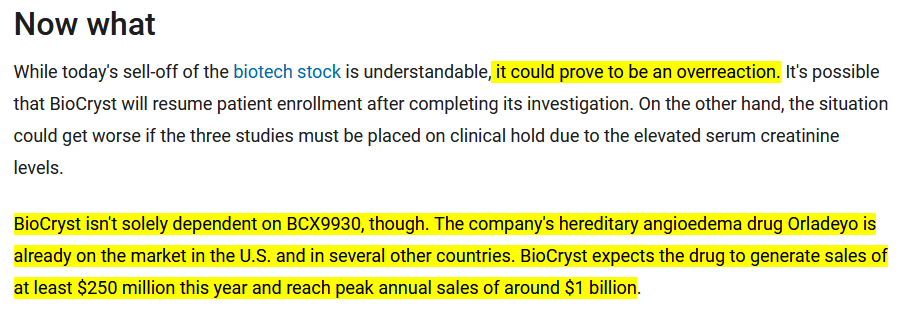

Now I think this might be an overreaction, come on now, I don’t know if I can justify this kind of drop off a company that already has a drug on the market. This is a pause of NEW enrollments while they investigate, not a pause of the trial, which current participating patients will continue. Along with the screenshot from the motley fool article.

Now let’s look at the fact that we saw quite a bit of institutional buying in the days before this drop.

Fintel Institutional Ownership

So, what’s my move here?

Simply a gap fill, now this doesn’t have to happen. This is a HIGH RISK play, I am simply showing the possibilities. I will not set targets for a play like this because the gap doesn’t have to fill. This is oversold on every time frame up to, & including the daily. It as well had a super high short volume day & volume day in general.

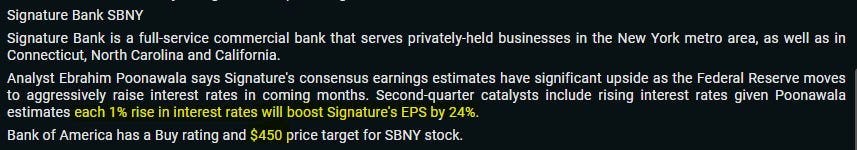

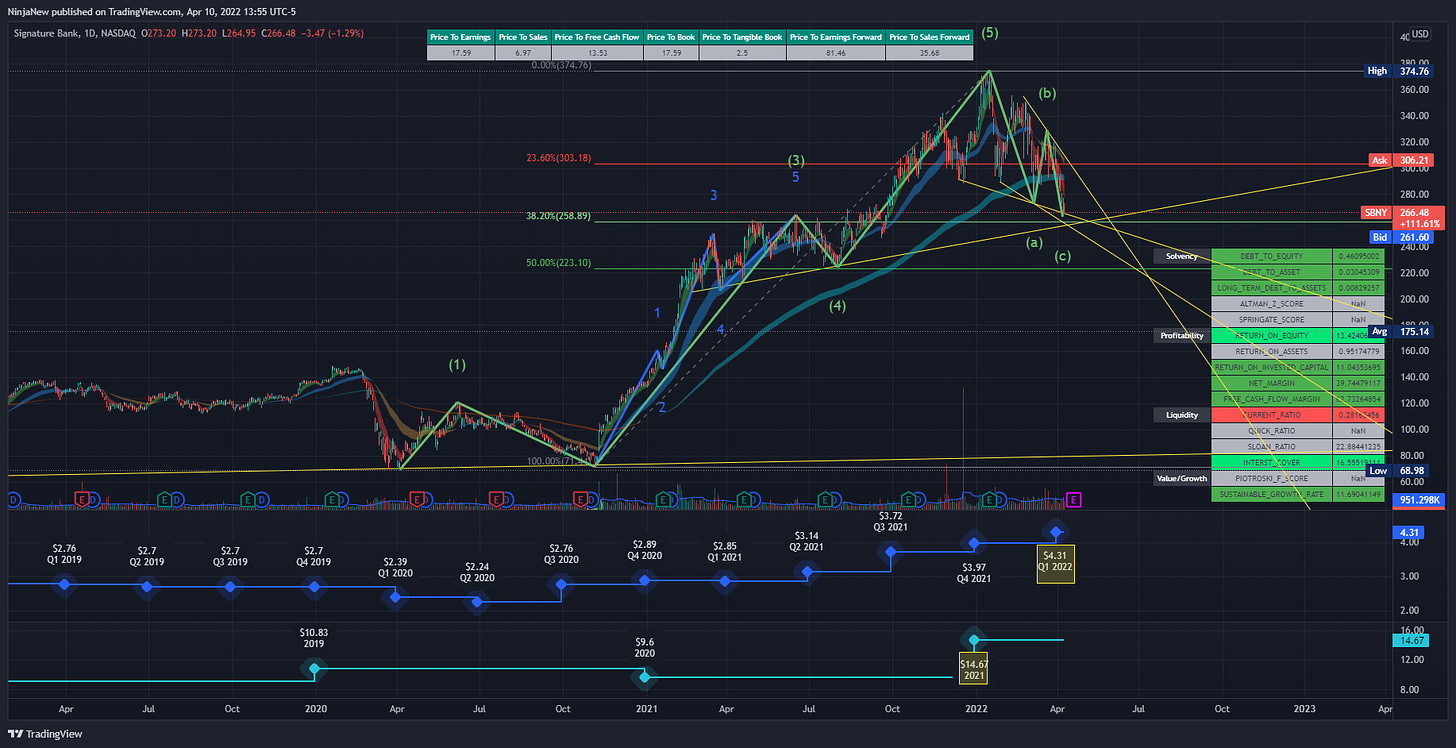

SBNY (Signature Bank) Website

Here is where we are looking for a longer term play most likely, but I see plenty of upside to this. Banks will most likely be hot spots as interest rates rise, for e.g.

The stock currently sits at 266.48 I see 2 scenarios playing out, and I would play these scenarios 2 different ways if I was buying commons vs. options.

It falls down through the 38.20% retracement to the $250.00 - $255.00 range then quicky bounces back to the trend line & continues upward.

It falls and continues through the 38.20% retracement to the 50% retracement. I would feel completely confident in buying between $225.00 - $235.00 range, slowing DCA in (if buying commons).

Option wise, I would need a 100% confirmation a reversal has happened, I do not mind avg. down a little, but do not want to have to do it and eat theta along with it.

as you can see in the picture, I have added the fundamentals to the chart. As well you can see the EPS only keeps rising (imagine this with interest rate hikes).

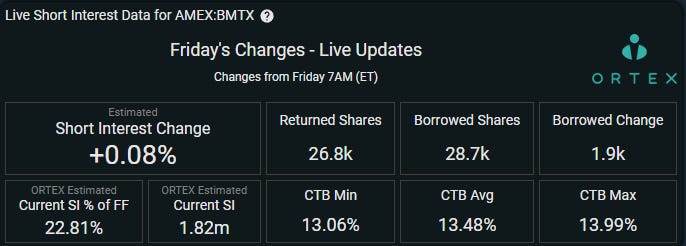

BMTX (Bm Technologies) Website

I checked out the website on BM Technologies, and I can say I like the concept. Now I don’t know who all their competition is, or how tight the market is for something like that, but I do think it is something that could gain traction. I will suggest you check out the website yourself (link above). I will leave you with this, it’s a company who does electronic banking that is looking partner companies that can brand their own banking system of the sort. T-Mobile is currently one of their partners, along with some colleges as well, from what I can tell. I think adoption of a product like this pretty much guaranteed. How fast? I honestly do not know.

Now I noticed that short volume has slowed down on this (shown in chart), yet still estimated to be 22.81% SI of the FF. I think short sellers know this stock might have a solid bottom around the $8.00 range just waiting for buyers. From what I can tell is the EPS keeps growing Qtr to Qtr. Now I can’t say this will be a fast play, but to be honest I wouldn’t mind starting to DCA into this. If it pops, great. If it’s a slow play, that’s fine to, that just sweetens the pie.

I currently don’t truly have set personal targets on this, but if I was to set some, I would be happy with a Target of $11.00 & $14.50.

Analyst target is 1yr price of $19.33 (EPS going forward looks good).

So, guys that about wraps it up. I know this was kind of lengthy, so I will try to cut the next one down a little bit, as I know there is a lot to read. I hope everyone found something useful out of this and its not to scattered (wrote this with my kids bugging me). I will alert trades during the week in the discord as I see them. Hope everyone had a good weekend, and let Monday bring us BIG bags of money!

See you in Valhalla,

The Stock Odin